Sustainability

EXEDY Group's Sustainability Activities

Information Disclosure Under the Recommendations

of the Task Force on Climate-related

Financial Disclosures (TCFD)

The EXEDY Group aims to achieve carbon neutrality (substantially zero greenhouse gas emissions) by 2050 in response to the international challenge of preventing global warming. We are working on the introduction and development of next-generation electrified products and future products. In addition, we have expressed our support for the Climate-related Financial Disclosure Task Force (TCFD), the TCFD Consortium, and the Japan Climate Initiative (JCI), and are working to strengthen the resilience of our strategies (ability to adapt and survive) by analyzing the impact of climate change on our business and the resulting risks and opportunities based on multiple scenarios and reflecting them in our management strategies and financial plans.

Here, we will explain the status of our efforts in compliance with the TCFD recommendations.

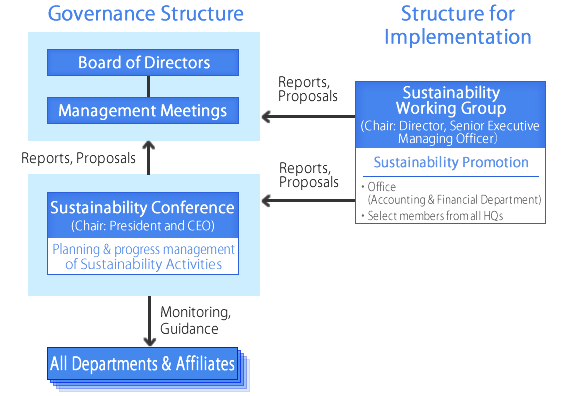

Governance

The EXEDY Group recognizes climate change as an important environmental issue, and after deliberation by the Management Committee and the Board of Directors, has chosen to contribute to the creation of a decarbonized society as one of its Long-term Visions, and has established climate-related KPIs (key performance indicators). In addition, to achieve the vision and KPIs, we have established a Sustainability Committee as a meeting body that formulates sustainability action plans and manages progress. This meeting is chaired by the President & CEO, and attended by all executive officers (including those stationed overseas) and the full-time corporate auditors, and is held twice a year. The committee deliberates and decides on medium- to long-term goals and the necessary responses based on laws and regulations and the needs of interested parties, and discusses matters that are deemed to have a significant impact on the business at the meeting of the Management Committee and the Board of Directors. In addition, we have formed the Sustainability Working Group as a working force to promote sustainability activities. The group is chaired by a director and senior managing executive officer, and its members are elected from each headquarters, promoting activities across the company.

Strategy

Scenario Assumption

To understand the potential financial impact of climate change on EXEDY Group's operations and to identify climate-related risks and opportunities, we referred to external scenarios such as the International Energy Agency's (IEA) World Energy Outlook and the 2° Investing Initiative as benchmarks. We also reviewed the scenario analysis for the automotive industry, assumed an overall scenario based on the company's perception of its longterm business environment, and identified climate-related risks and opportunities by analyzing the differences between the scenario and our long-term strategy.

The scenario definition was based on the analysis of all projects on a global basis and classified into two categories: 4°C scenario (case of little progress in addressing global warming) and below 2°C scenario (case of accelerated global warming), for the two axes of transition risk and physical risk.

Transition risk

Parameter |

Current |

4°C scenario ※3 |

Below 2°C scenario※4 |

Provenance |

|

|---|---|---|---|---|---|

Carbon price |

Carbon price |

- |

- |

FY2030: 100 |

IEA "WEO 2021" ※5 |

Changes in the |

Electricity rate |

216 |

FY2050: 184 |

FY2050: 242 |

IEA "WEO 2018" |

CO2conversion index |

FY2019 : 0.46 |

FY2030: 0.31 |

FY2030: 0.16 |

IEA "WEO 2020" |

|

Raw material |

Iron price |

350 |

FY2050: 382 |

FY2050: 506 |

2DII The Transition |

Changes in |

Gasoline diesel |

Current status(=100%) |

100% in 2050 |

90% reduction in 2050 |

2DII The Transition |

EV penetration rate |

0.3% |

FY2030 5% |

FY2030 39% |

Global Calculator |

Physical risk

Parameter |

Current |

4°C scenario※3 |

Below 2°C scenario※4 |

Provenance |

|

|---|---|---|---|---|---|

Average |

Air conditioning cost |

about 19 |

FY2030 : about30 |

FY2030 : about30 |

IEA ”The Future of Cooling” |

Intensification of |

Flood frequency |

FY2018:(100%) |

FY2040 : 400% |

FY2040 : 200% |

MLIT “Recommendations for Flood Protection Planning in the Context of Climate Change” 2019 |

Occurrence of typhoons |

26 cases/year in 2016 |

Decrease in frequency, potential |

Japan Meteorological Agency / Environment Agency |

||

※1:Limited Climate Transition、

※2:Ambitious Climate Transition、

※3:Case where global warming countermeasures do not make much progress

※4:Case where global warming countermeasures are accelerated (1.5°C scenario in some cases),

※5:International Energy Agency "World Energy Outlook"

※6:2° Investing Initiative(2DII)

Identifying climate-related risks and opportunities

After analyzing the differences between the above scenarios and our understanding of the business environment, which is the premise for the EXEDY Group's long-term strategy, we have identified the key items that we believe will have a huge potential financial impact on our business, as follows.

Main risks

Key Items |

Potential Financial Impact |

Time axis |

Countermeasures |

|---|---|---|---|

Tighter Government |

Increase in direct costs due to introduction of renewable energy

|

Mediumterm |

|

Tighter regulations |

Decrease in sales due to suspension of sales of

|

Long-term |

|

Increased severity and frequency |

Decrease in sales due to factory shutdowns

|

Mediumterm |

|

Main risks

Regarding the transition risk, we evaluated that the potential financial impact on the EXEDY Group's business is high due to stricter government regulations on greenhouse gas emissions, stricter regulations on existing products, and market changes. Regarding physical risks, we evaluated the above impact of increasing severity and frequency of extreme weather events to be high.

Main opportunities

Key Items |

Potential Financial Impact |

Time axis |

Countermeasure |

|---|---|---|---|

More efficient production |

Lower energy costs through

|

Mediumterm |

|

Development and sales |

Increase in sales due to higher demand for products for HEVs

|

Mediumterm |

|

Development of new products |

Increased sales due to increased demand

|

Mediumterm |

|

Main opportunities

As for opportunities, we believe that the utilization of more efficient production and logistics processes, the development and sales expansion of low-emission products, and the development of new products through R&D and technological innovation have a high potential financial impact on the EXEDY Group's business.

Impact on management strategy

In order to strengthen the resilience to the impact of the carbon-neutral movement on the EXEDY Group's product development and production system, which we have recognized by identifying the risks and opportunities mentioned above, we are implementing the following two points.

The first is the formulation of a Long-term Vision that incorporates climate change countermeasures and the announcement of a sustainability declaration. In our Long-term Vision, we aim to contribute to the creation of a decarbonized society through both product expansion and production systems. In addition, in the sustainability declaration, we have announced that we will achieve carbon neutrality by 2050.

Secondly, we are strengthening our product development structure through open innovation and organizational restructuring. As for open innovation, we concluded a capital and business alliance with Aster, a company with strengths in high-output, compact motors. As part of our organizational restructuring, we have integrated the Development Headquarters and the Motorcycle Clutch Headquarters, and newly established the Development Planning Department, Smart Technology Department, and other departments. In addition, electric product representatives from the Development, Purchasing, Production Engineering, Quality Assurance, and Manufacturing Headquarters have been assembled to prepare for the mass production of electric products across the entire company. By strengthening these product development systems, we will accelerate the technological development of motor-centered drive unit products, including BEV wide-range drive systems and motorcycle electric units, utilizing EXEDY's drive technology and Aster's motor technology.

Impact on financial planning

There are also two main impacts on financial planning.

The first is an increase in the R&D expense ratio for new product development. As mentioned earlier, against the backdrop of carbon neutrality, it is necessary to expand the number of new products that contribute to decarbonization and strengthen the development system for new products. Accordingly, in our financial plan, we plan to increase the ratio of new product development expenses to R&D expenses from 29% in 2019 to 90% by FY2050.

The second point is to account for the purchase of renewable energy. As part of our production system for carbon neutrality, we plan to start purchasing renewable energy sources in FY2024 and have incorporated this into our consolidated medium-term management plan.

Risk Management

The EXEDY Group's risk management action guideline is to prepare in advance to prevent emergencies and minimize damage. To ensure that these measures are implemented, we conduct risk management after evaluating and identifying risks. We identify major risk items related to safety and health, environmental preservation activities, and business continuity management activities, based on the frequency of occurrence, degree of impact, and surrounding conditions. We are working to strengthen our management system by clarifying the department responsible for each risk, the degree of impact of each risk, the causes of its occurrence, and proactive preventive measures.

Regarding climate-related risks, the Sustainability Committee plays a central role in analyzing scenarios, assessing and identifying risks, and managing the progress of response measures. The status of the response to major risks is as follows. Regarding the risk of sales decline due to the suspension of sales of internal combustion engine vehicles, etc., the Management Committee and the Board of Directors have discussed the issue, and developed a Long-term Vision, and strengthened the product development system. Regarding the risk of increased direct costs from the introduction of renewable energy due to stricter government regulations, the Sustainability Working Group is researching and studying measures to address this issue, including gathering information on renewable energy options. Regarding the risk of supply chain disruptions due to floods and other disasters, the Risk Management Committee, consisting of the President & CEO, (Senior) Executive Managing Officers, and fulltime Audit and Supervisory Board Members, is discussing and promoting business continuity plans for suppliers and other parties.

Metrics and Targets

The EXEDY Group is working to achieve carbon neutrality by 2050, and has set the following targets for FY2030 and FY2050 based on the "NET GHG (greenhouse gas) emission reduction rate" as a climate-related KPI, and is confirming progress at the Sustainability Conference.

Metrics |

NET GHG Emissions Reduction Rate |

|---|---|

Targets |

FY2030 -46% <compared to FY2019> |

Actual |

Reduction rate 20.7% <Compared to FY2019> |

As described above, the EXEDY Group recognizes climate change as an important environmental issue and has positioned the Board of Directors and the Sustainability Committee as governance and the Sustainability Working Group as the business promotion organization to establish KPIs and promote sustainability activities. Also, we have analyzed the circumstances surrounding our company based on multiple scenarios to identify significant risks and opportunities, and have estimated the potential financial and strategic impact of climate change on our business, and reflected this information in our management strategies and financial plans. In particular, we have incorporated measures to address major risks and opportunities into our Long-term Vision and consolidated medium-term management plan. By steadily implementing these measures, we will strengthen the EXEDY Group's resilience against the impact of these risks on product demand and other factors.